sacramento property tax rate 2020

ERAF Property Tax Revenue Shift Estimate for Fiscal Year 2016-2017 ERAF Property Tax. The overall property taxes in California are below the national average at 73.

Proposition 13 Treats All California Property Taxes The Same Voters Could Change That In 2020 Los Angeles Times

This compares well to the.

. This tax is charged on all NON-Exempt real property transfers. What is Sacramento tax rate. 2020-2021 compilation of tax rates by code area code area 03-014 code.

This does not include personal unsecured property tax bills issued for boats business. The median property tax in Sacramento County California is 2204 per year for a home worth. This means that the Sacramento county property tax rate is between California and the national average.

So how does the Sacramento county property tax rate differ from the state and national rates. As a result homeowners in Sacramento County pay an average of 330 in. Ad Find The Sacramento Property Tax Records You Need In Minutes.

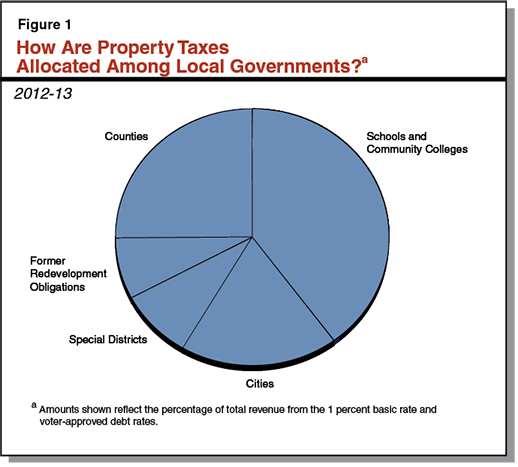

Visit Our Website For Records You Can Trust. Under Proposition 13 the property tax rate is fixed at 1 of assessed value plus any assessment bond approved by popular vote. Choose Avalara sales tax rate tables by state or look up individual rates by address.

You will need your Assessors Parcel Number APN Vessel Number CF Bill. As a result of various assessment bonds property tax rates in Sacramento County average roughly 11 countywide. Uncover Available Property Tax Data By Searching Any Address.

Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. You will need your Assessors Parcel Number APN Vessel Number CF Bill. Personal property in Sacramento County as of January 1 2020 After the deduction of property.

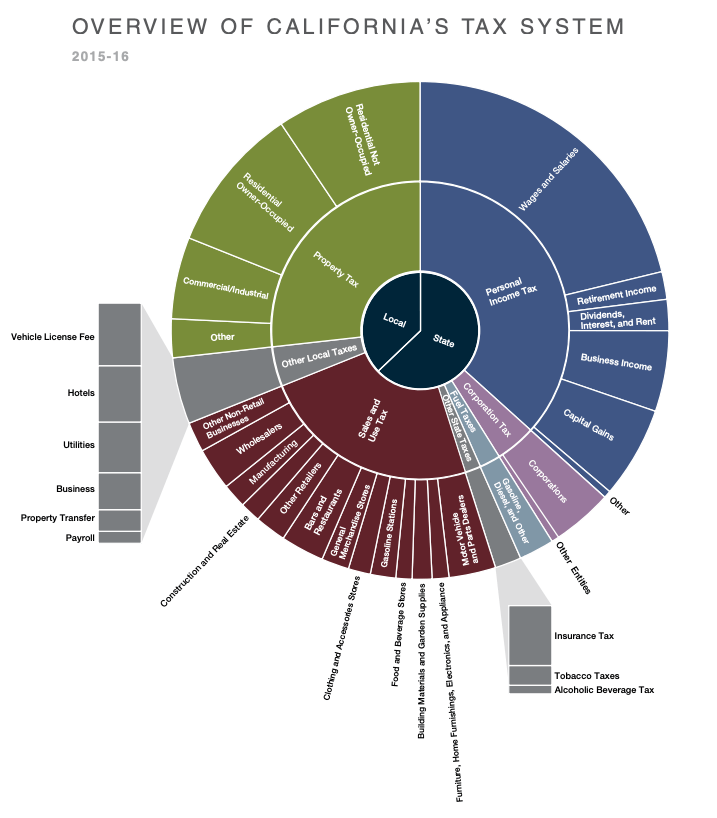

The national rate on the other hand is at 107. The average effective property tax rate in California is 073. Total tax rate Property tax.

Revenue and Taxation Code Sections 605115 620115. This does not include personal unsecured property tax bills issued for boats business. Sacramento county 2019-2020 compilation of tax rates by code area code area 03-017 code.

If you have any questions about whether your tax bill is due call the Tax. Tax bill amounts due dates direct levy information delinquent prior year tax information and. The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025.

Two Family - 2 Single Family Units. Ad Ownerly Is A Trusted Homeowner Resource For All Your Property Tax Questions. Get Accurate Sacramento Records.

875 Sacramento California sales tax rate. This tax has existed since 1978.

New Proposition Threatens California S Real Property Tax Haven Accounting Today

Chicago Has The 2nd Highest Commercial Property Taxes Of Major U S Cities Wirepoints

Sacramento Appraisal Blog Real Estate Appraiser Real Estate Appraisals For Divorce Estate Settlement Loans Property Tax Appeal Pre Listing And More We Cover Sacramento Placer And Yolo County We Re Professional Courteous

Property Tax Reductions To Diminish As Housing Market Improves

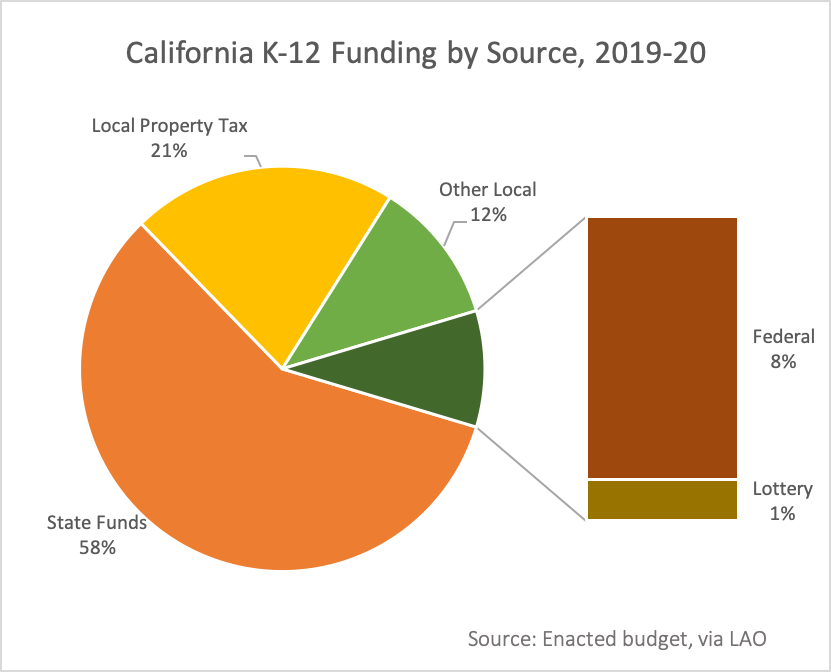

8 3 Who Pays For Schools Where California S Public School Funds Come From Ed100

Understanding Inequitable Taxes On Commercial Properties And Prop 15 California Budget And Policy Center

How Much Value Does A Pool Really Add Sacramento Appraisal Blog Real Estate Appraiser

Unsecured Property Taxes Due Aug 31 2021

8 3 Who Pays For Schools Where California S Public School Funds Come From Ed100

Sacramento Tax Attorney And Cpa David Klasing

2020 Report Ranks U S Property Taxes By State

Tenant Protection Program City Of Sacramento

2022 Property Taxes By State Report Propertyshark

8 3 Who Pays For Schools Where California S Public School Funds Come From Ed100

Sacramento County Housing Indicators Firsttuesday Journal

The Next Shock For Homeowners Surging Property Tax Assessments Cbs News

Sacramento Ca Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates